Running a business is hard enough — let’s not make your financials harder. Whether you’re a startup founder or a seasoned entrepreneur, preparing your 2024 income statement and balance sheet doesn’t have to mean late nights, messy spreadsheets, or last-minute tax-season panic.

Unsure about your 2024 financials? Please join us for a webinar on Tuesday February 18 to learn a few expert ways to get your 2024 IRS-ready, without the last-minute panic. RSVP here.

Here’s your step-by-step guide to streamline bookkeeping, avoid costly errors, and get ready to file your taxes with confidence.

Why Having Accurate Financials for 2024 Matters

Having accurate year end financials matters as it helps with:

- Improved tax compliance: Being compliant with tax regulations can help avoid penalties.

- Increased investor/lender confidence: Having clear financials can attract capital.

- Faster and more accurate business decisions: The virtuous cycle: Tracking profitability and growth can lead to more profitability and growth.

For example, the founder of a beauty company discovered that even though her business is growing and is currently profitable, her direct-to-consumer (DTC) revenue has been dropping since the pandemic. Since discovering this, she has set a goal to discover new channels for growth and adjust her DTC strategy in 2025 to address this issue.

Three Steps Founders Can Use to Dial In Financials

Leveraging a modern tech platform (like myPocketCFO!) is the way to save time and $$.

Most small business owners today use a combination of accounting software and manual data collection to pull together their financial data for tax preparation. Although some software systems can automate parts of the process, this is still typically a tedious task.

You may be feeling this now.

Without integration and automation, the process of wrapping up the previous year's finances can take anywhere from a few weeks to a couple of months, depending on the complexity of your business and the state of your financial records.

To streamline this process, you can adopt real-time practices and leverage integrated solutions to automatically update and categorize transactions throughout the year, starting now. This approach can significantly reduce the time needed to prepare for tax season this year.

There are three steps in the process:

- Connect your financial data

- Share key business details

- Review and finalize your book

Step 1: Connect Your Financial Data

Automate data entry in as little as 15 minutes

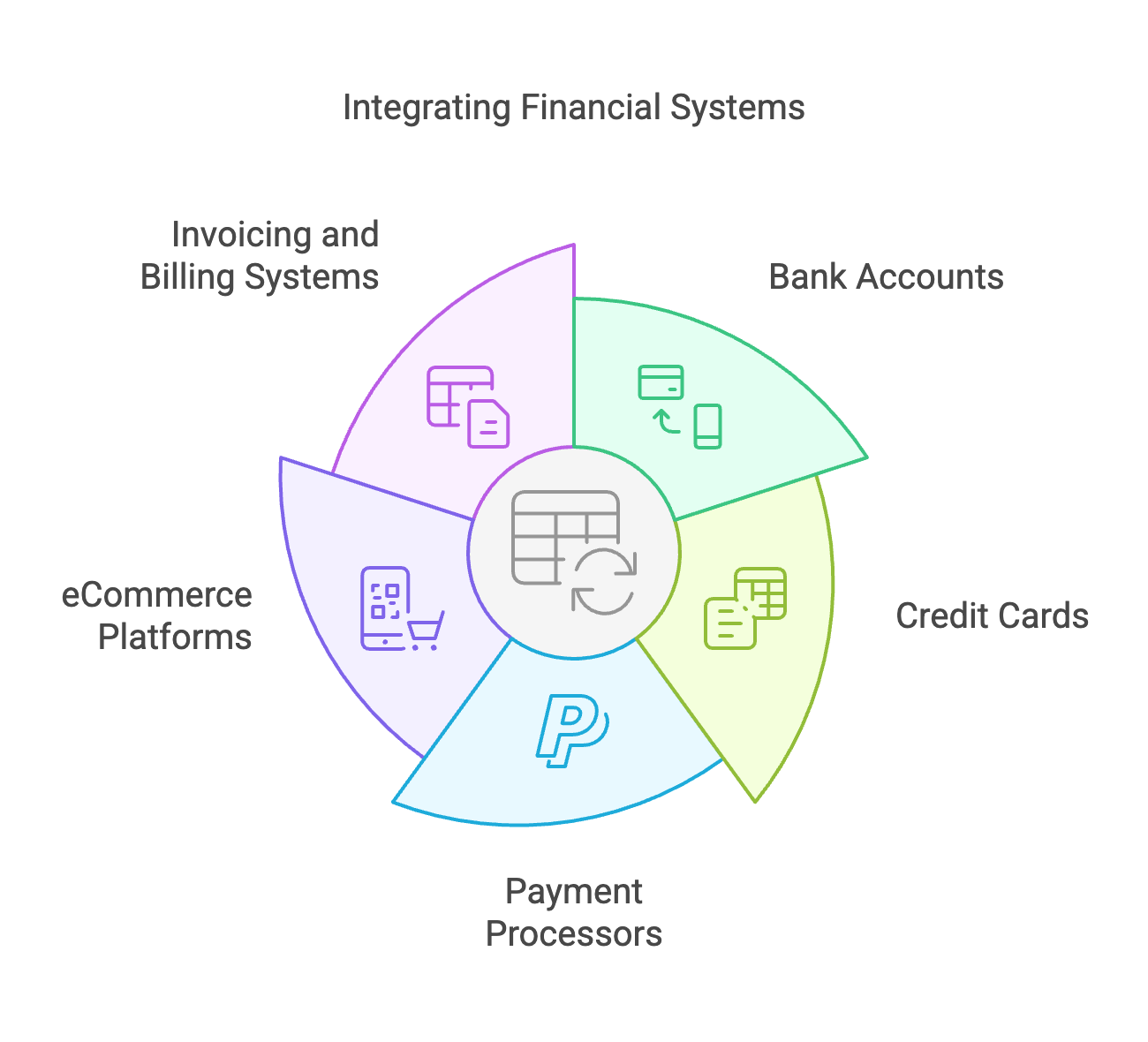

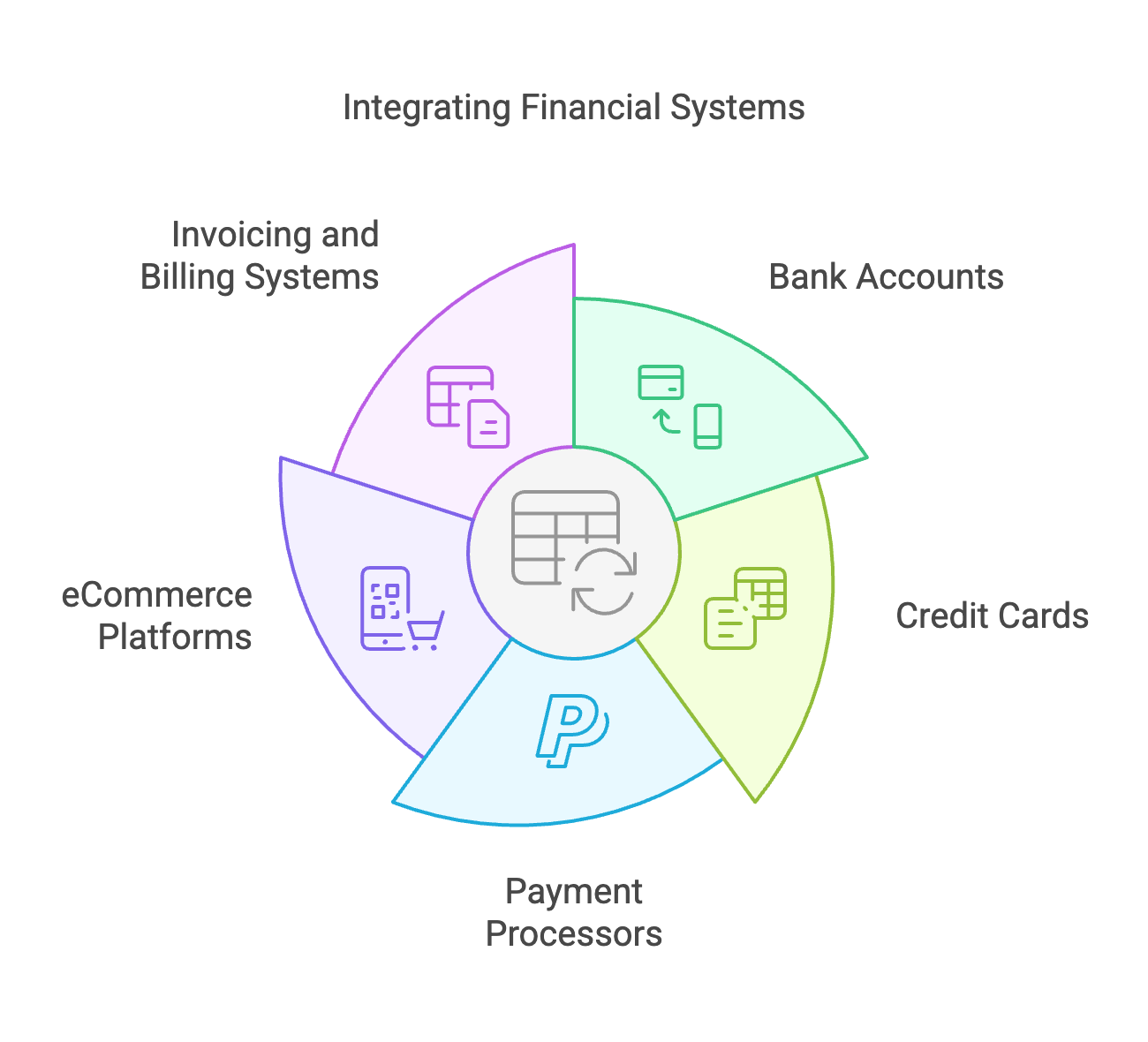

The first step is to connect your financial systems to get rid of the manual data entry. This is a significant part of the process and the key to getting the pipeline flowing. You’ll link all the accounts you can, and then upload the last few pieces for transactions that can’t be auto-linked.

- Link accounts: Bank, credit cards, payment processors (e.g., Stripe, PayPal), eCommerce platforms, invoicing and billing systems such as Quickbooks.

- Upload manually: Excel/CSV files for transactions not auto-linked.

Step 2: Share Key Business Details

Help us understand your business by sharing business rules with the platform

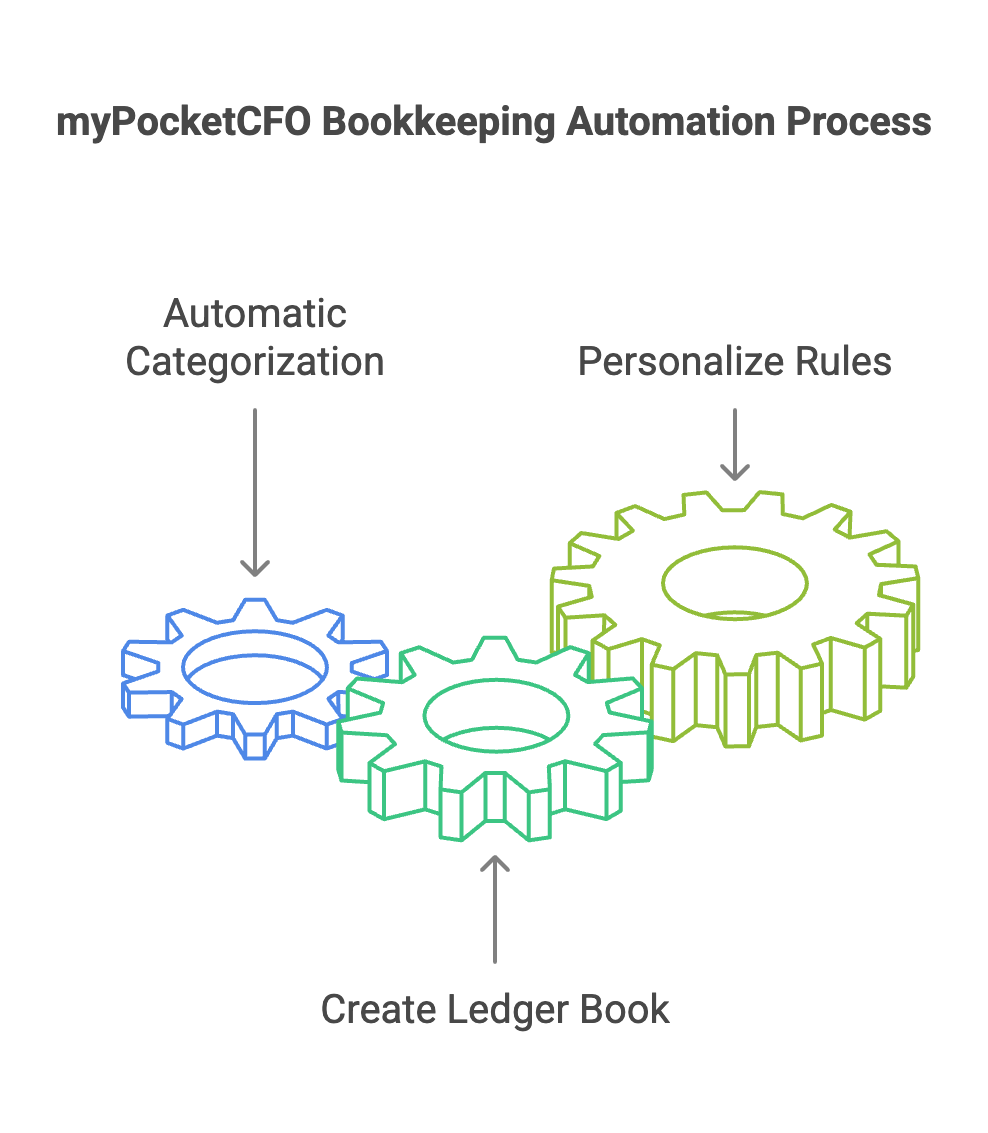

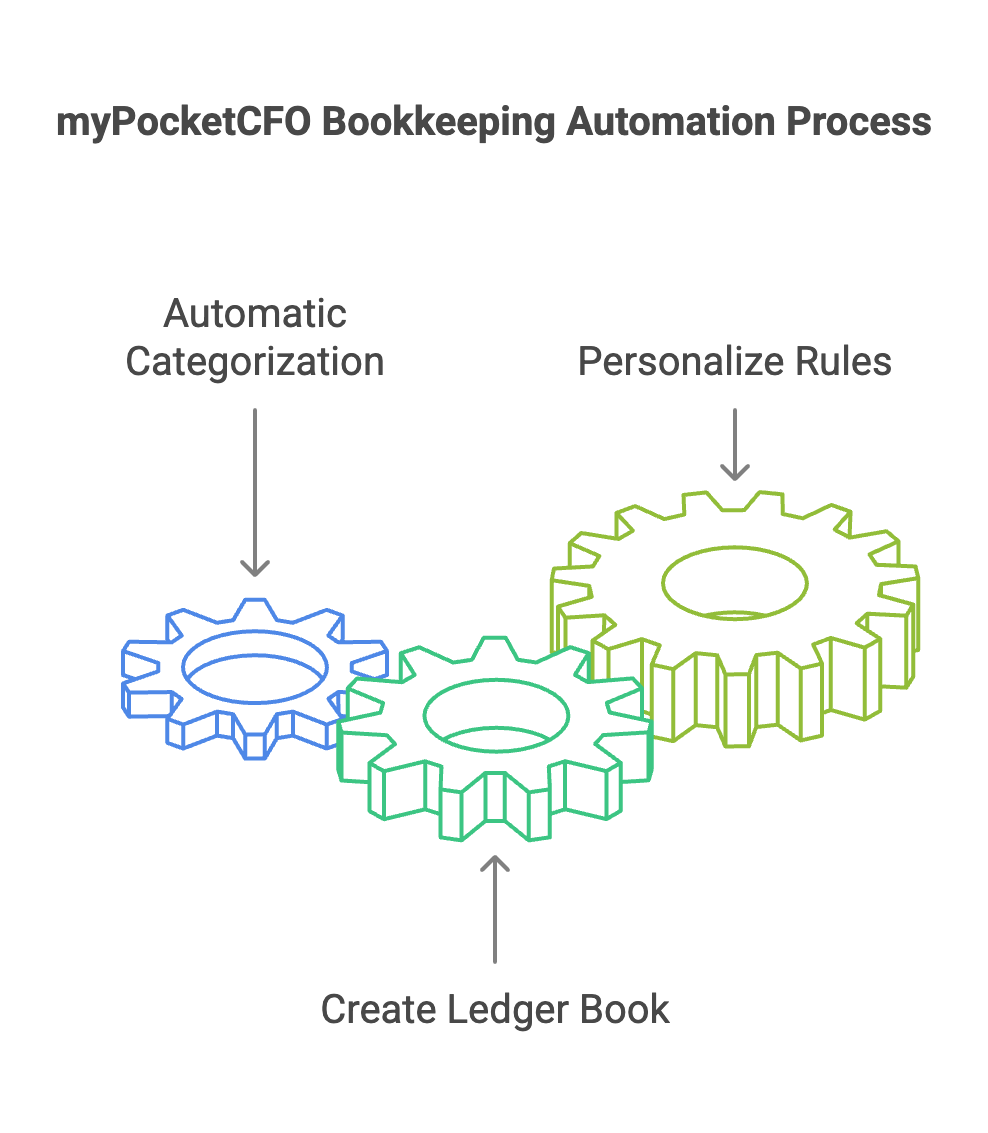

Once your financial data is connected, the next step is to provide key business details that shape your financial picture. This includes outlining where your revenue comes from, such as direct sales, eCommerce platforms, or wholesale accounts, and specifying when payments are typically received.

You'll also categorize expenses (like costs of goods sold (COGS), recurring vendor payments, and operational expenses) so they are tracked accurately.

If your business has outstanding loans, investor funding, or fixed assets such as equipment, capturing these details will help ensure a complete and accurate financial overview.

By defining these items upfront, myPocketCFO can automatically categorize and organize transactions, reducing manual work and ensuring your financial statements reflect your business reality with minimal effort.

For example:

- Revenue Sources:

- Sales channels (e.g., Amazon, farmer's markets).

- Payment timelines (e.g., Stripe pays out every 2 days).

- Costs & Vendors:

- COGS (e.g., $2/unit for granola ingredients).

- Top vendors (e.g., packaging supplier: PackIt Co.).

- Debt/Investors:

- Loans (e.g., $50k SBA loan from Bank of America).

- Investors (e.g., $200k from Angel Investor Jane Doe).

- Fixed Assets:

- Equipment (e.g., $20k commercial oven).

Step 3: Review Your Automatically Generated Financials

Know your numbers!

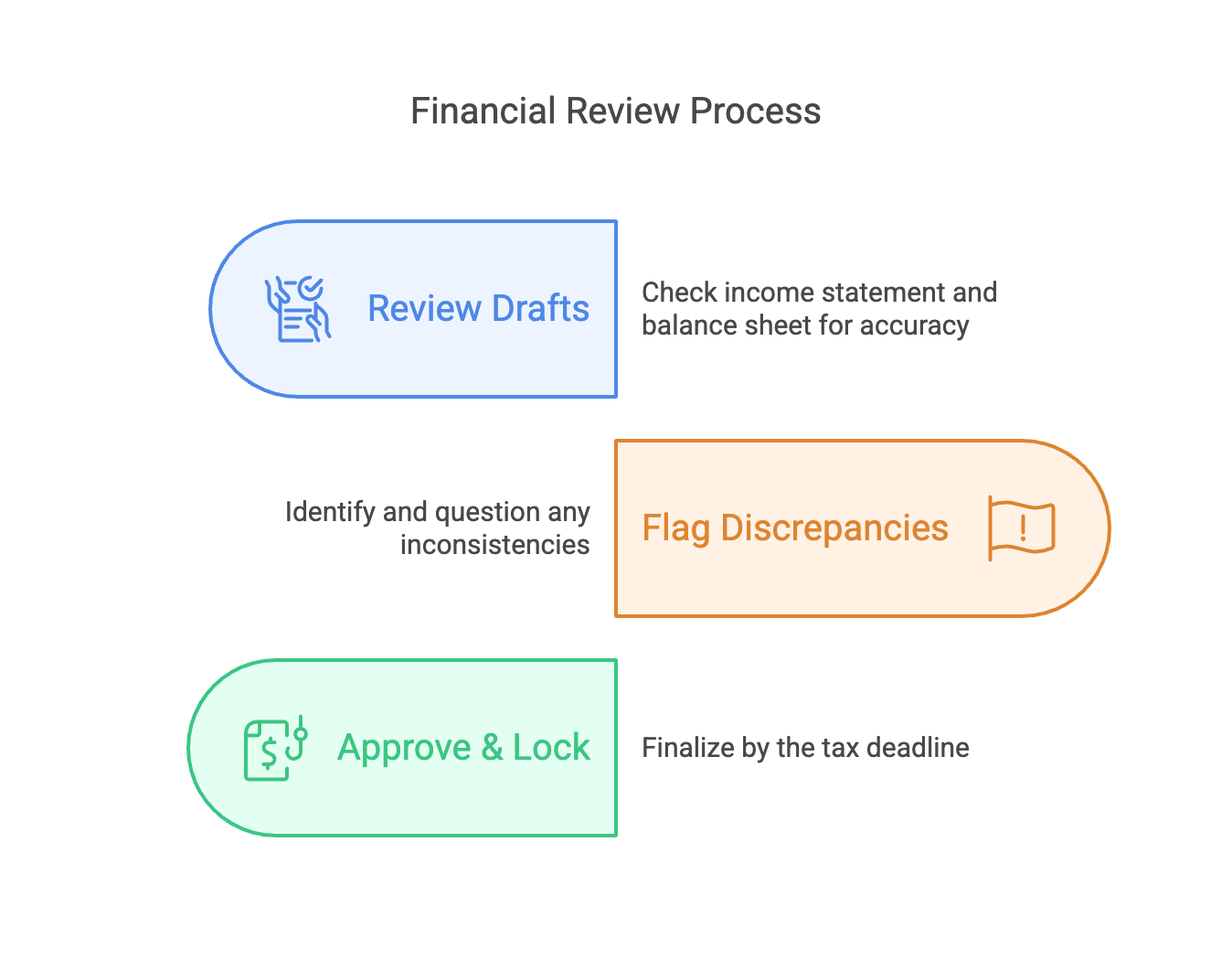

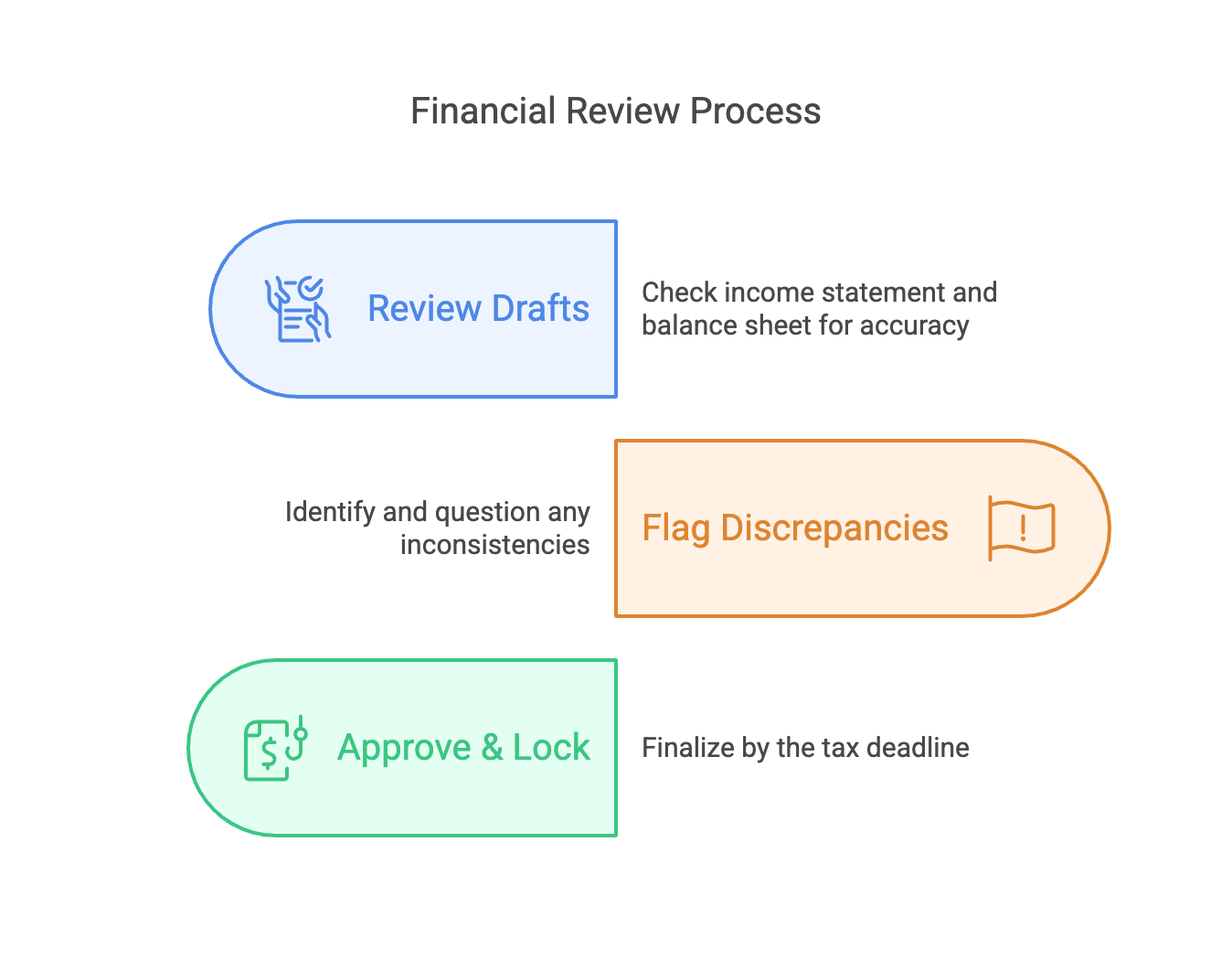

After connecting your financial data and sharing key business details, myPocketCFO will generate draft financial reports, including your income statement and balance sheet.

At this stage, your role is to review these drafts for accuracy and completeness. Look for discrepancies, such as unexpected spikes in expenses, missing revenue entries, or incorrect categorizations. If something doesn’t look right, you can flag and adjust transactions to ensure everything aligns with your records.

Regularly reviewing and finalizing these reports not only keeps your books tax-ready but also helps you make informed business decisions throughout the year.

Once everything checks out, you can lock your financials in place, keeping your tax preparation smooth and stress-free.

- Review drafts: Check income statement and balance sheet for accuracy.

- Flag discrepancies: Example: “Why is marketing spend $5k higher?”

- Approve and lock: Finalize by your organization’s tax deadline. The small business tax filing date for 2025 in the US depends on the business structure. (It's important to note that if your business uses a fiscal year different from the calendar year, your filing deadline will be different.)

- For S Corporations and Partnerships: Monday, March 17, 2025

- For C Corporations and Sole Proprietorships: Tuesday, April 15, 2025

Common Mistakes to Avoid

Save time, skip headaches

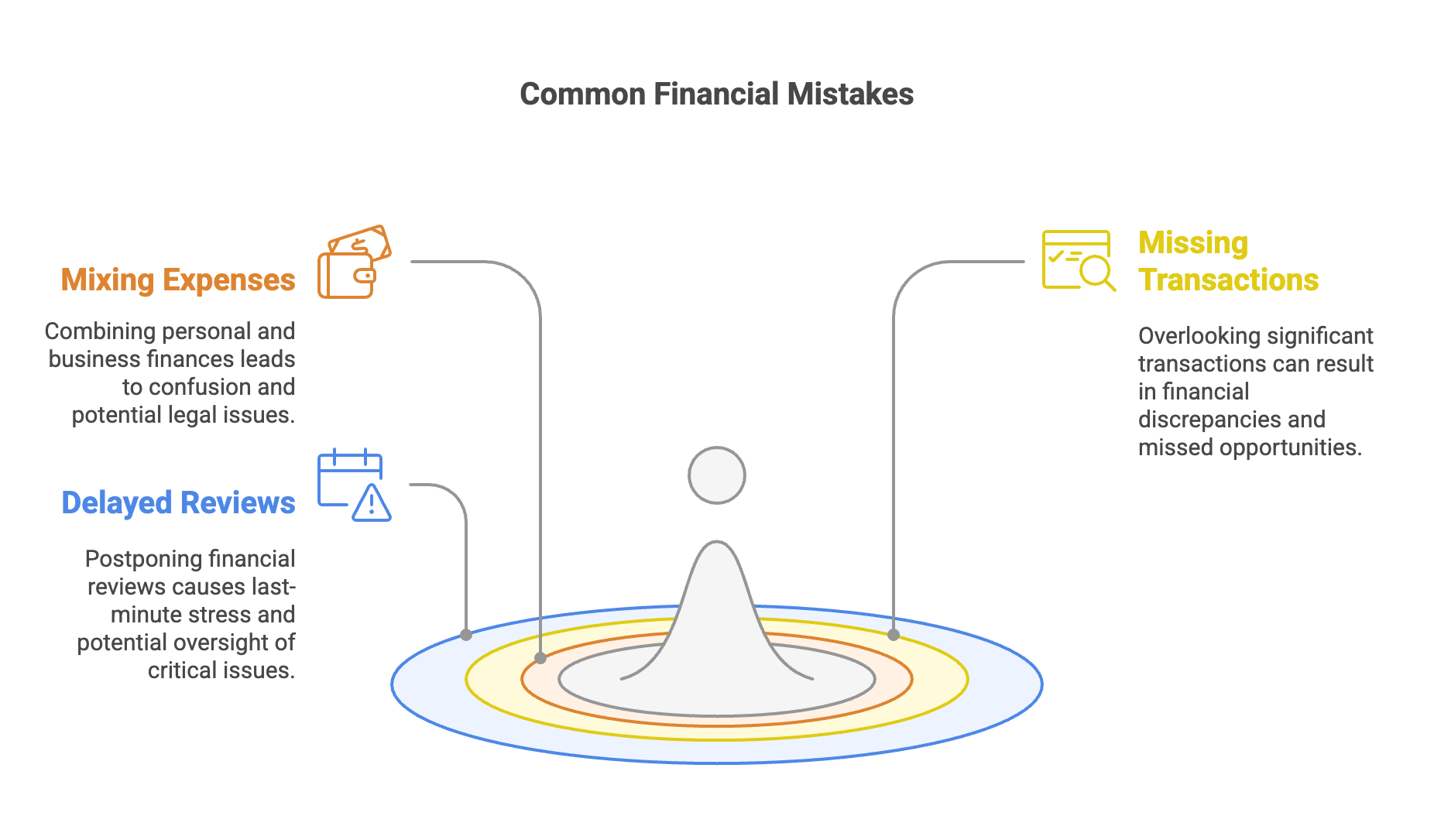

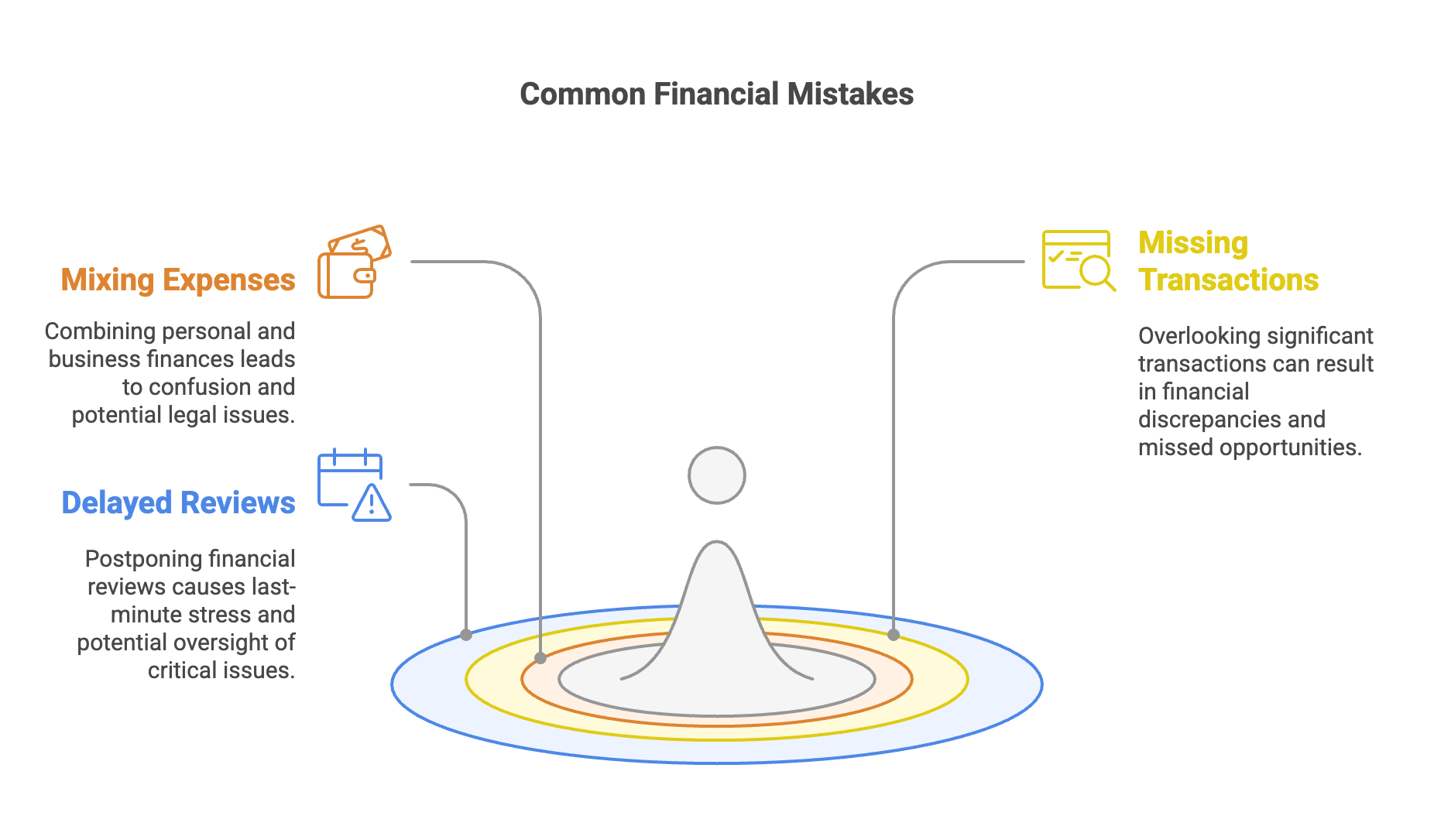

Even with automation, small mistakes can add up to big problems come tax season. For example, one of the most common errors is mixing personal and business expenses. This can create confusion, make tax deductions harder to track, and even raise red flags with the IRS.

Another frequent mistake is missing or forgetting transactions, whether it’s a vendor invoice that hasn’t been recorded or a payment that didn’t sync properly. These gaps can lead to inaccurate financial statements and potential cash flow issues.

Lastly, delaying financial reviews until the last minute can result in rushed corrections, missed opportunities for tax deductions, and unnecessary stress.

By setting aside just a few minutes each month to review and categorize transactions, you can stay ahead of these common pitfalls and ensure your books are always in order.

Next Steps

Let’s get started!

Preparing your 2024 financials doesn’t have to be overwhelming. By automating data entry, categorizing key business details, and regularly reviewing your financial statements, you can eliminate the stress of last-minute tax prep and make smarter financial decisions year-round. With the right tools and a proactive approach, you’ll not only be more likely to stay tax-compliant but you'll also gain better insight into your business’s financial health.

Two more things you can do...

- Join us for tomorrow’s webinar on Tuesday February 18 👉 here.

- Reach out to us to learn more about how we can help you get insights into the financial vitals of your business.

Let's get tax ready!