In the world of business, having a clear understanding of your financial vitals is just as important as knowing your health vitals. Financial vitals are essential for business owners, providing a real-time snapshot of your company’s financial health, allowing for better decision-making and proactive problem solving, helping you make informed decisions and proactively address issues before they become crises.

Let’s explore what financial vitals are, why they matter, and get into the details of the eight essential financial vitals every business owner should monitor closely.

The Problem: Flying Blind in a Storm

Many small business owners and startup founders often feel like they’re flying blind when it comes to their finances. Drowning in numbers, they’re left guessing whether they’ll have enough cash flow for next month’s payroll or if a late payment from a key customer will derail operations. This uncertainty can be stressful and reactive rather than proactive.

Even investors sometimes struggle to gauge the financial health of portfolio companies without sifting through lengthy and complex reports. Ashley, the founder of organic snack brand B.T.R. Nation, describes it as “like flying in the dark” — always hoping for the best without a clear sense of direction.

The Solution: Simple, Apple Watch-Like Financial Vitals

Imagine if your business had a financial health monitor similar to an Apple Watch, showing vital signs like revenue, expenses, and cash flow at a glance. That’s the idea behind financial vitals — simple, easy-to-read metrics that provide an instant overview of your company’s financial health.

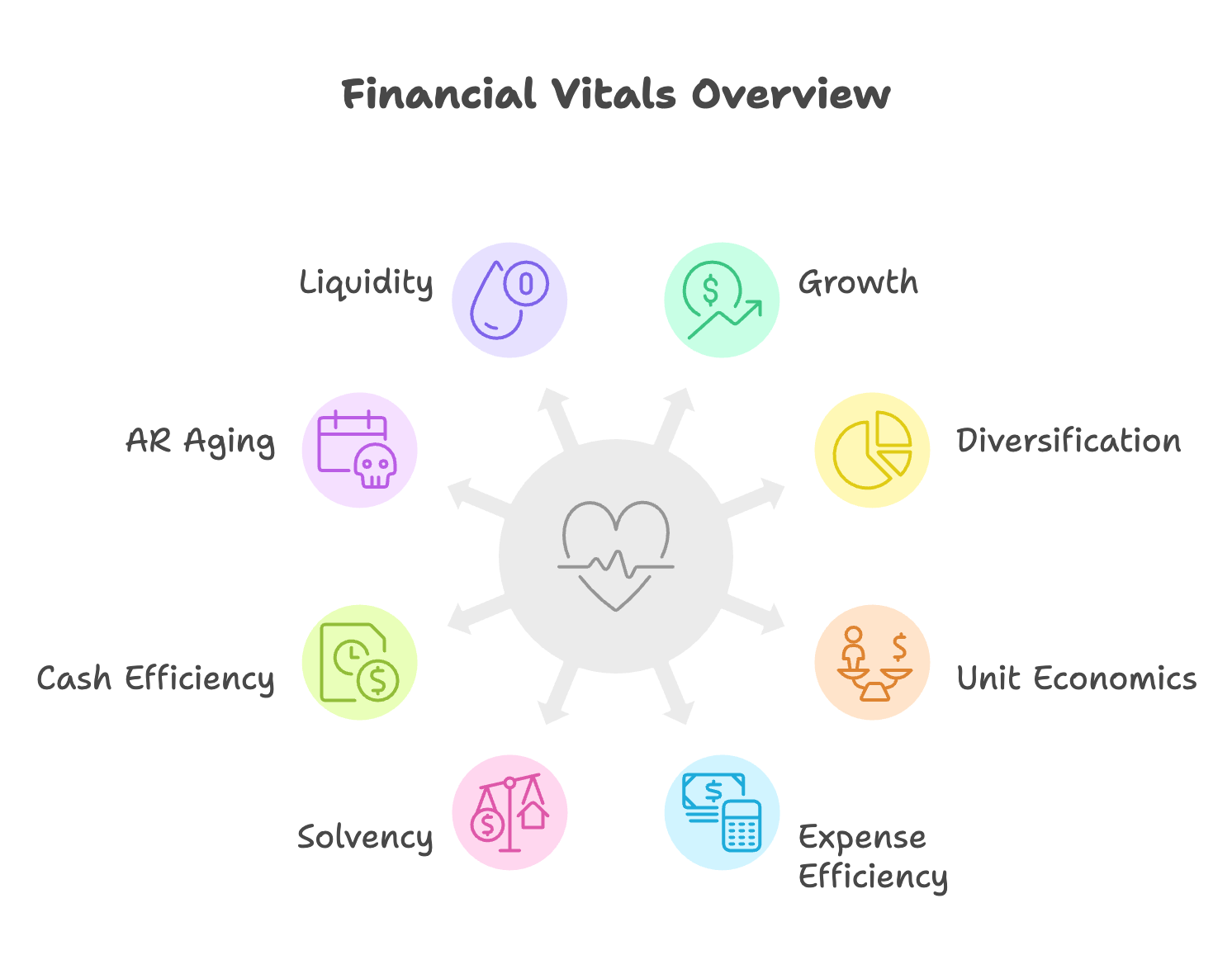

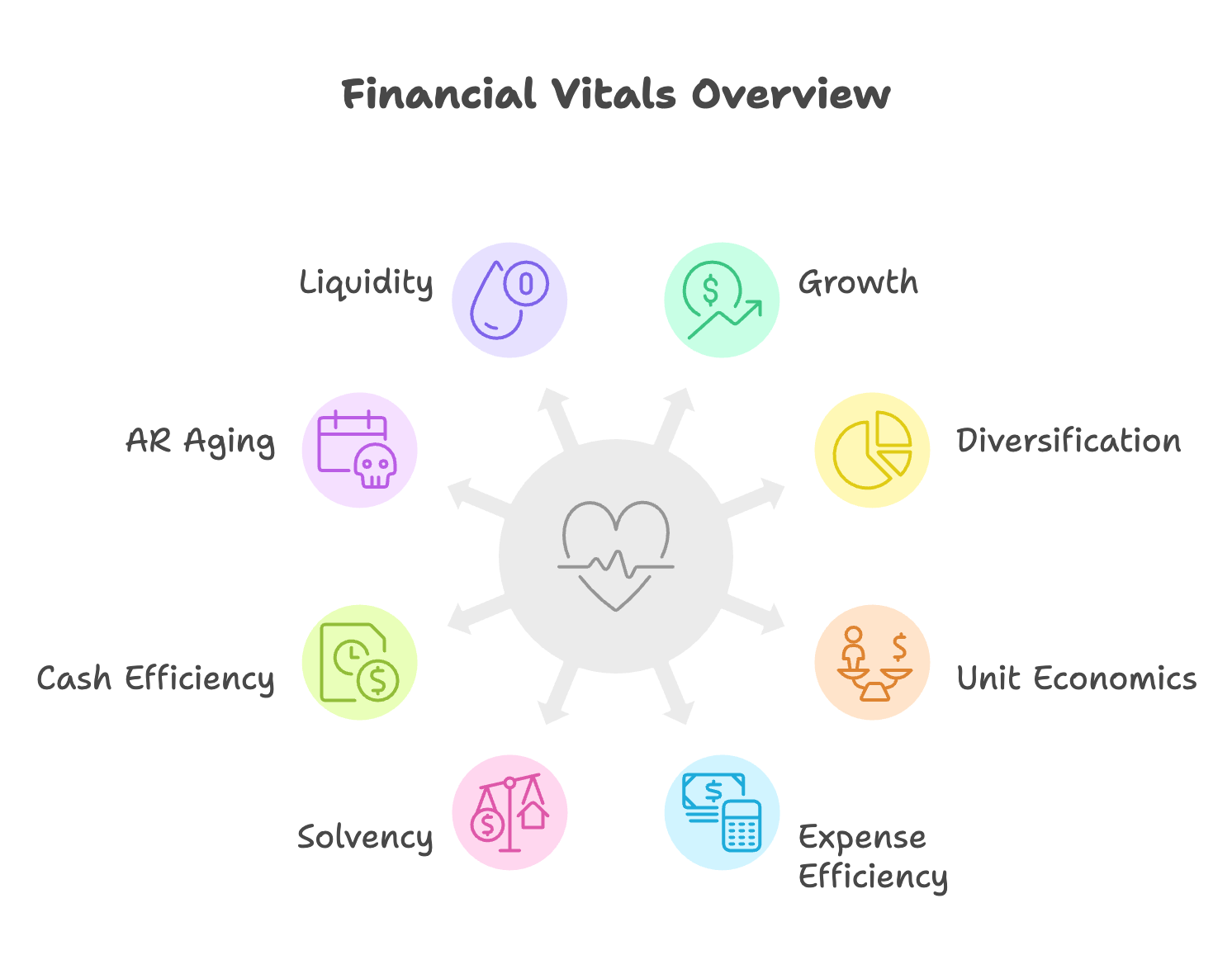

myPocketCFO’s 8 Financial Vitals are designed to simplify finance, making it easy for business owners to understand their financial position and make better decisions in real time.

The 8 Essential Financial Vitals Every Business Must Track

Financial vitals act like a CT scan for your company’s health. By monitoring these key metrics, you can quickly spot early warning signs of potential financial issues such as cash flow crises, rising debt levels, or declining revenue growth.

For example, a low gross margin may indicate that your business is underpricing products or facing high production costs. Conversely, a high AR aging percentage may signal that customers are taking too long to pay, impacting your cash flow.

Here are the key financial vital signs to monitor for your business:

1. Growth (from Income Statement)

Revenue Growth (G%) is the heartbeat of your business. Consistent growth indicates a healthy business, while stagnant or declining growth signals potential issues that need attention.

2. Diversification (from Income Statement)

Revenue by Channel % measures the distribution of revenue across different channels (e.g., eCommerce as a % of total revenue). Understanding your revenue diversification helps you identify risks and opportunities, ensuring your business isn’t overly reliant on a single revenue source.

3. Unit Economics (from Income Statement)

Gross Margin (GM%) represents the margin after production costs, providing a clear view of how much revenue is left to fuel growth. This vital is like your business’s “net calories” — if it’s too low, your business may struggle to scale.

4. Expense Efficiency (from Income Statement)

Tracking your Selling and Marketing Expense as a Percentage of Sales helps you understand how efficiently your business turns marketing dollars into revenue. This vital answers the question: For every dollar spent on sales and marketing, how much revenue is generated?

5. Solvency (from Balance Sheet)

Debt Ratio % measures your company’s solvency by comparing total liabilities to total assets. A high debt ratio indicates that your business may be over-leveraged, while a lower ratio suggests financial stability.

6. Cash Efficiency (from Balance Sheet)

Days Sales Outstanding (DSO) measures how long it takes for your business to collect payment after a sale. A high DSO indicates cash flow issues, while a low DSO suggests efficient cash collection.

7. AR Aging (from Balance Sheet)

AR Aging % tracks the percentage of accounts receivable (AR) that are aged over 90 days. A high AR aging percentage signals potential cash flow problems and may indicate that your business needs to tighten credit terms or improve collection efforts.

8. Liquidity (from Balance Sheet)

Quick Ratio (Cash + AR / Current Liabilities) measures your company’s ability to meet short-term liabilities using liquid assets such as cash and accounts receivable. A high quick ratio indicates strong liquidity, while a low ratio suggests potential cash flow challenges.

Just like you have your health vital signs measured with every regular checkup you have with your doctor, you should be regularly measuring the financial vital signs of your business on a regular basis.

Real-World Results

Business owners who monitor financial vitals have seen significant improvements in financial clarity and decision-making:

- A beauty CPG company used financial vitals to identify stagnating growth and diversify revenue channels.

- A food and beverage company monitored its debt levels and implemented a strategy to pay down debt more effectively.

The Bottom Line: Why Financial Vitals Matter

In an era where 82% of small businesses fail due to cash flow mismanagement (according to a U.S. Bank study), tracking your financial vitals isn’t just a nice-to-have — it’s a must-have. Understanding your financial vitals allows you to feel in control of your business’s health rather than simply crossing your fingers and hoping for the best.

Want to monitor your business’s financial vitals?

Try myPocketCFO’s Beta Financial Vitals for FREE and check your business’s financial health as easily as your daily step count.